25 FREE Excel templates to download and use for your small business.

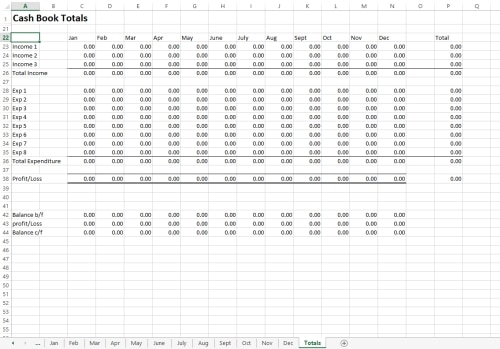

Our Free Excel Bookkeeping Templates are great for managing basic bookkeeping and accounting tasks using Microsoft. They are available to download for business or personal use. The most popular template is the Cash Book, suitable for recording business transactions for Limited companies, self-employed individuals, self-assessment and personal use.

If you require assistance with any of our free accounting spreadsheets or cannot locate what you need, please don’t hesitate to contact us. We may be able to design a bespoke spreadsheet just for you.

Our Free Excel Bookkeeping templates have 320,000+ downloads and are used by many small businesses, non-profits and charities.

Our free Excel bookkeeping templates are a good place to start with your business finances, but when your business grows, they can hold you back. This is where accounting software comes in, offering a double-entry bookkeeping solution that streamlines operations, saving time and money.

Some of the best bookkeeping packages worth looking into are Xero, QuickBooks and Sage.

XERO – 75% Discount for 6 Months

QuickBooks – 90% Discount for 7 Months

Here are our Excel accounting templates:

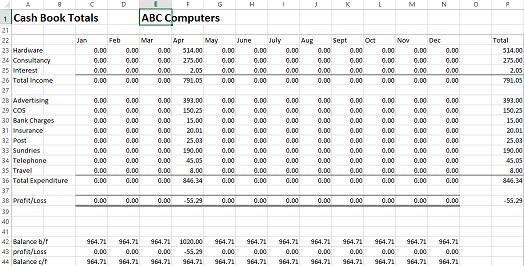

Our top bookkeeping template is the cash book, as it makes tracking income and expenses for small businesses and charities easy. It will produce the figures needed for an Income statement (Profit and Loss). We have had many people thanking us for the ease of use.

Why you’ll love it:

There are 3 different Excel bookkeeping templates depending on the business setup and needs, including standard, extended (more categories and rows) and self-employed, which runs from April.

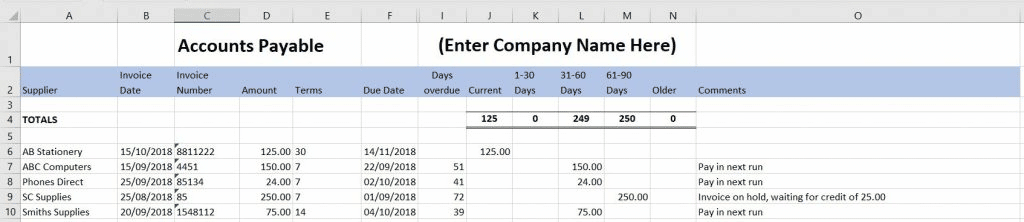

The first Excel Bookkeeping template helps you manage your supplier payments easily using our Accounts Payable Excel template. Track outstanding invoices, see overdue amounts at a glance, and avoid late fees.

Sort the data by due date or supplier to prioritise payments. A handy comments section lets you note important details. Ideal for small business owners.

The Accounts Receivable statement template allows you to list all your sales invoices issued to customers. It will calculate when an invoice is due and how many days are overdue.

The comments section makes it easy to see the status of an invoice. The data can be sorted by customer or date.

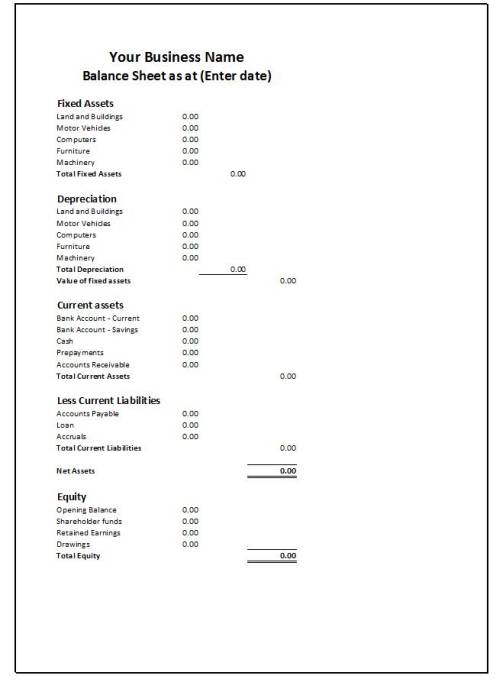

This is a simple Microsoft Excel spreadsheet to help you prepare a balance sheet. It shows the assets, liabilities, and equity at any given time.

A balance sheet is one of the financial statements and is a legal requirement for submitting your accounts if you run a limited company. Our balance sheet template helps look at financial ratios to see how the business performs.

A bank reconciliation worksheet is essential for identifying discrepancies between accounting software records and bank statements.

There can be timing differences between when a transaction occurs and what is shown on the bank statement.

Our bank reconciliation allows you to record the differences and balance the accounts on the bank statement.

The Excel budget worksheet lets you set a budget and track annual spending.

It is suitable for either personal or business use. The budget is set on one page and can be adjusted during the year if your circumstances change. By entering your bank transactions, you will see the differences between your budget and actual figures.

It is a useful Excel bookkeeping template if finances are tight or you want to make some savings.

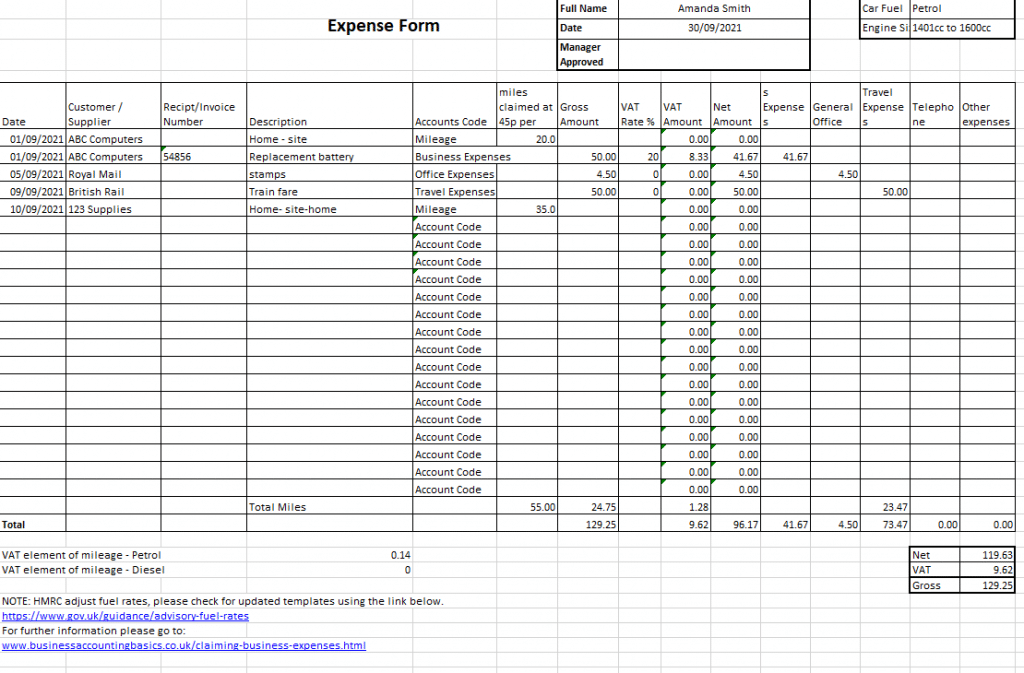

Most business expenditures can be claimed back, even if you are self-employed. There are two Excel bookkeeping templates for business expenses, one for VAT and one for non-VAT. All the calculations are completed for you once the figures are posted.

The rules for claiming business expenses can be complicated, so we have a guide explaining what you can claim.

Although we have already listed the cash book template as our top download, we wanted to make sure you hadn’t missed it.

Manage your finances effortlessly with our Excel-based Cash Book template. Track income and expenses with ease for personal, small business, and non-profit use.

The Cash Flow Forecast will enable you to set a forecast for a year. Knowing how much money you may have in a few months helps with your accounting and business planning.

The Excel accounting template will show the predicted money available. The income and expenses descriptions can be changed to suit the business. There are three templates available by month, week or day.

The cash flow statement illustrates the inflows and outflows of cash within a business, playing a pivotal role in the financial reports. It gives useful insights into where the money has come from and how it’s being spent.

There may be times when you need to issue a refund to a customer. There are various reasons for raising them, including the return of goods and query on the invoice.

Our Excel credit note accounting template will help you to produce a professional document.

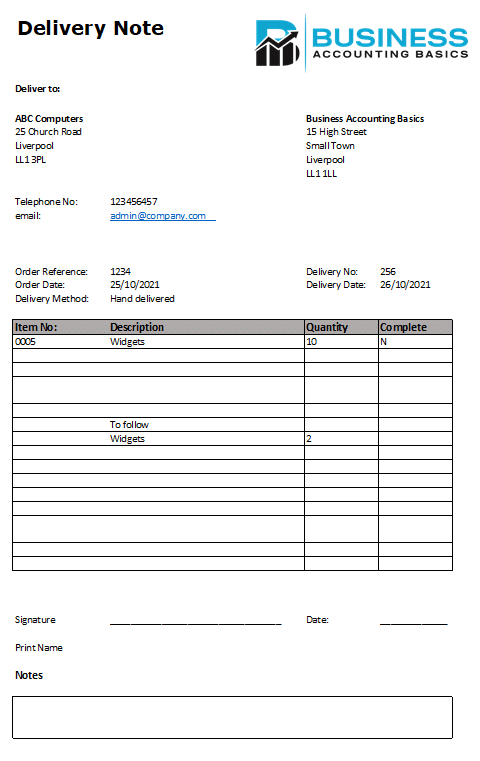

When delivering goods to a customer, a delivery note is required. It is not a legal document.

Please read our guide with a template in both Excel and PDF.

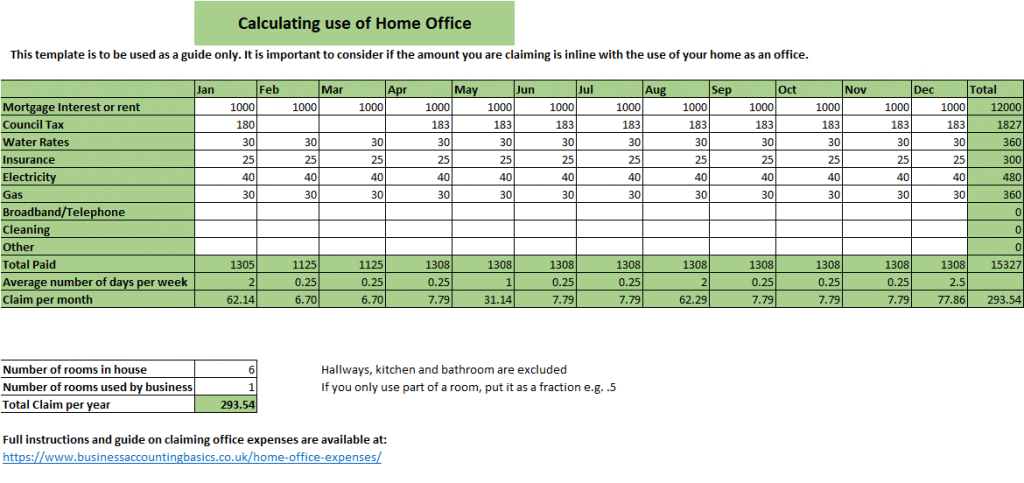

If you work from home, you can claim expenses. Read the complete guide on what you can claim. These include mortgage, rent, council tax, broadband, insurance, and utilities.

To help calculate the figures, there is a simplified calculator and an Excel bookkeeping template for home expenses.

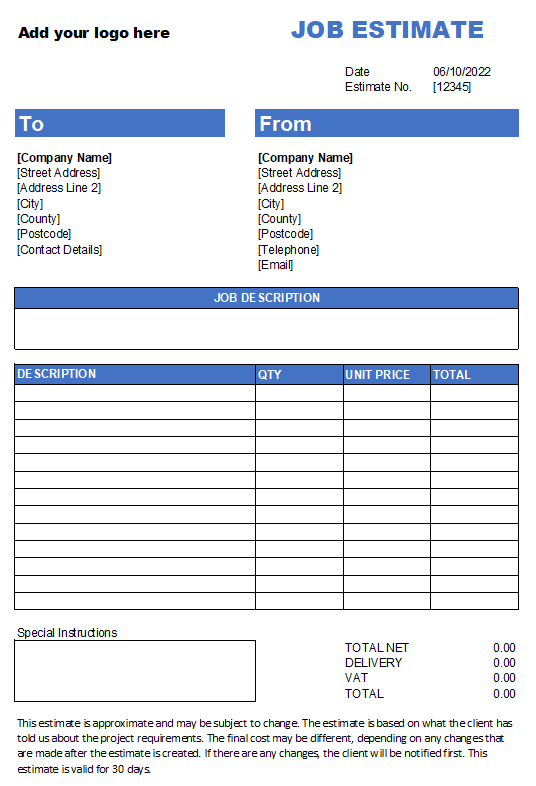

As a business, you might provide job estimates for your services to potential customers. Creating a professional-looking work estimate and giving it to the client promptly is essential.

Learn about producing a job estimate using our free spreadsheet.

If you need to adjust the figures in the accounts, a journal is required.

A journal is a simple form to move a transaction from one code to another.

Do you need to track your business mileage? Our simple mileage log allows you to use a PDF version or download an Excel Template.

All mileage can be reclaimed as an employee or business owner. Please read our guide to learn more about business expenses.

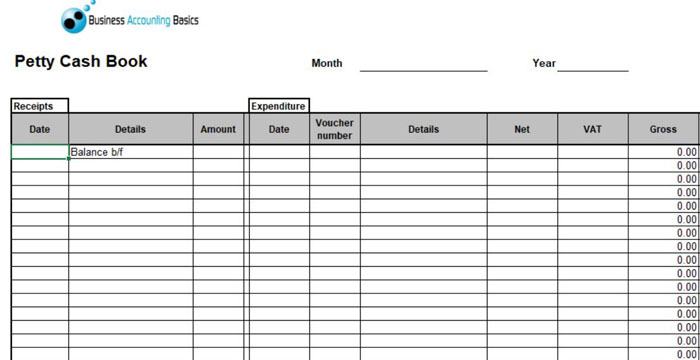

Our accounts spreadsheet is a log to assist in managing your petty cash transactions. You can record all income and expenditures over time, and the balance is automatically calculated.

It is designed to save you time calculating the figures. Then, you can post the totals to your accounting system.

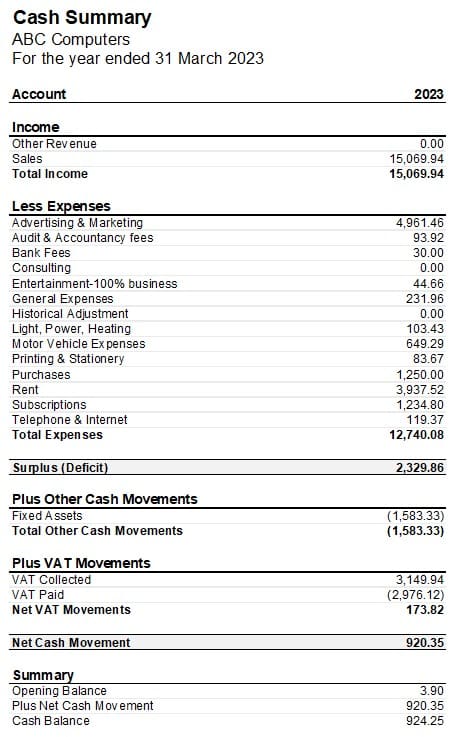

The Profit and Loss statement or Income Statement Excel accounting template allows you to add a year’s figures onto one page. It is helpful to see differences between income and expense figures over the year.

A P&L report, also known as an income and expenditure report, is one of the financial statements all businesses require at year-end to show profits or losses.

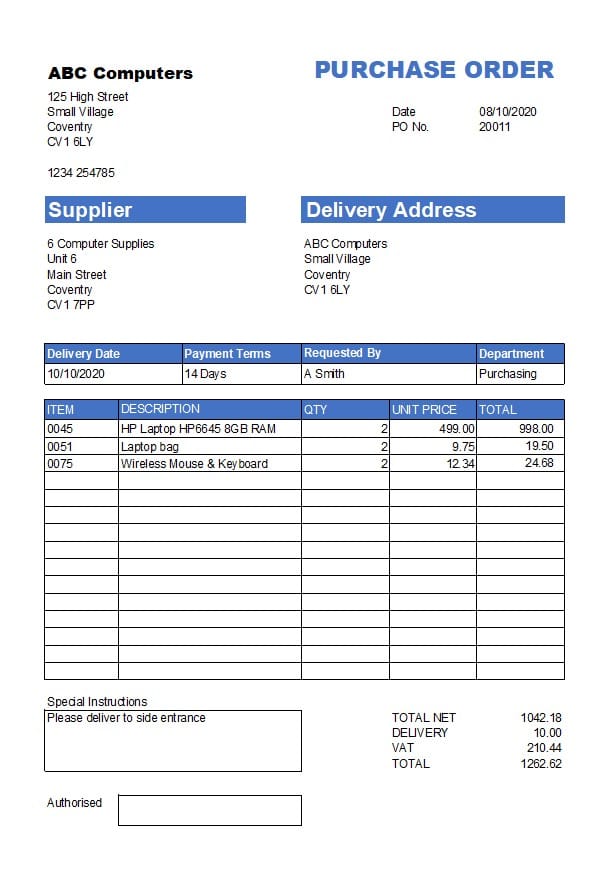

businesses that operate stock systems often need to generate supplier purchase orders. These purchase orders are official confirmations of the goods, quantity, delivery date, and price, ensuring efficient and transparent transactions.

Our easy-to-use Purchase Order template will automatically calculate total figures for you. We have also created a purchase order log to record all the orders.

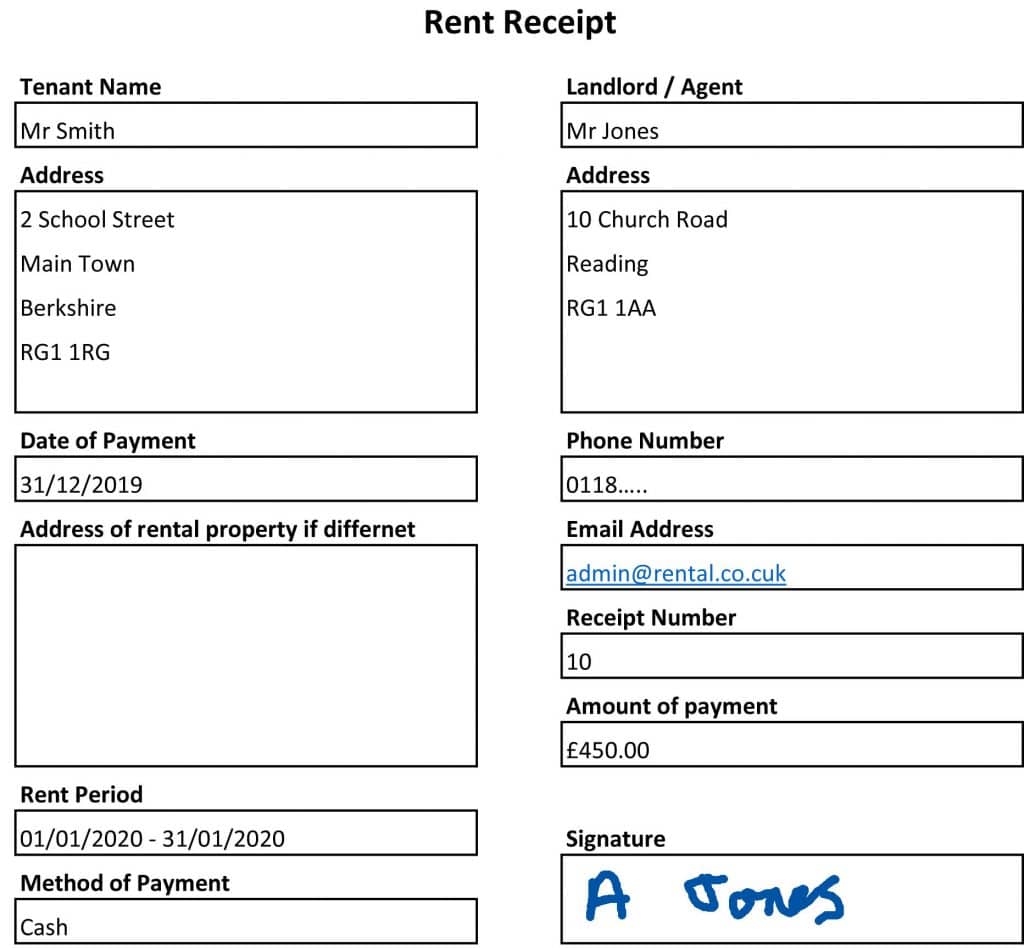

Keeping a rent receipt is crucial for accurately documenting payment transactions if you are a landlord or tenant. It serves as a vital record to ensure financial clarity and accountability.

We have produced an Excel rent receipt, letter and log to help keep track of payments over time.

The sales forecast Excel bookkeeping template helps small businesses track their sales figures and make necessary adjustments.

The free template offered on this website is easy to use and can be customised to include your products or services.

By entering actual monthly sales income, you can compare your projected sales with reality and adjust your forecasting methods as needed.

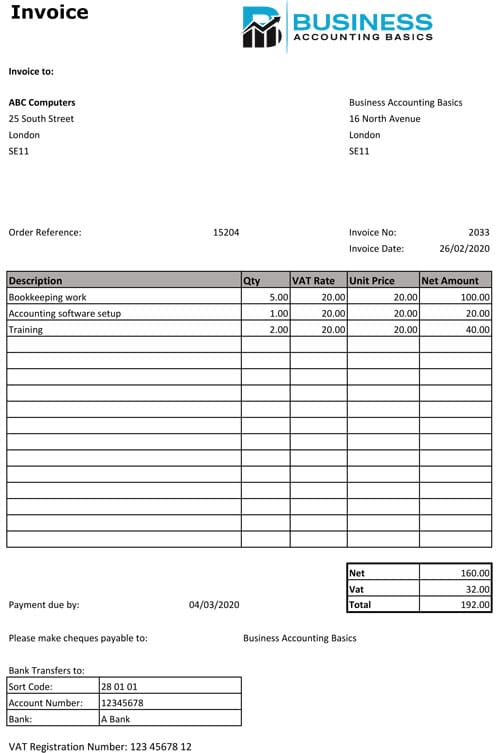

Our sales invoice template is easy to use and looks professional. It can be downloaded and saved with your logo and details, so whenever you want to produce a sales invoice, it is ready with your branding.

Add a full description of the sale, along with quantities and prices. The totals are calculated automatically to prevent mistakes.

The proforma invoice is for issuing before the supply of the goods or services.

We also have an invoice list, which allows you to have a complete list of all invoices, record when paid and show any outstanding invoices.

The sales receipt template is ideal if you attend fairs and need to issue a receipt to clients for a cash sale. It can be used as proof of purchase and a guarantee for goods or services.

The template can be downloaded in Excel or PDF format to complete by hand.

The statement of account or customer account template statement is used to remind customers how much they owe.

The statement template can be branded to your business by adding a logo and company information. It also includes a remittance form for the customer to complete so you will know which invoices they have paid.

The T Account template is one of the most popular templates for students to learn about the general ledger entries and visualisation of accounts.

It is easy to use and allows users to input specific values to see how the account would be affected.

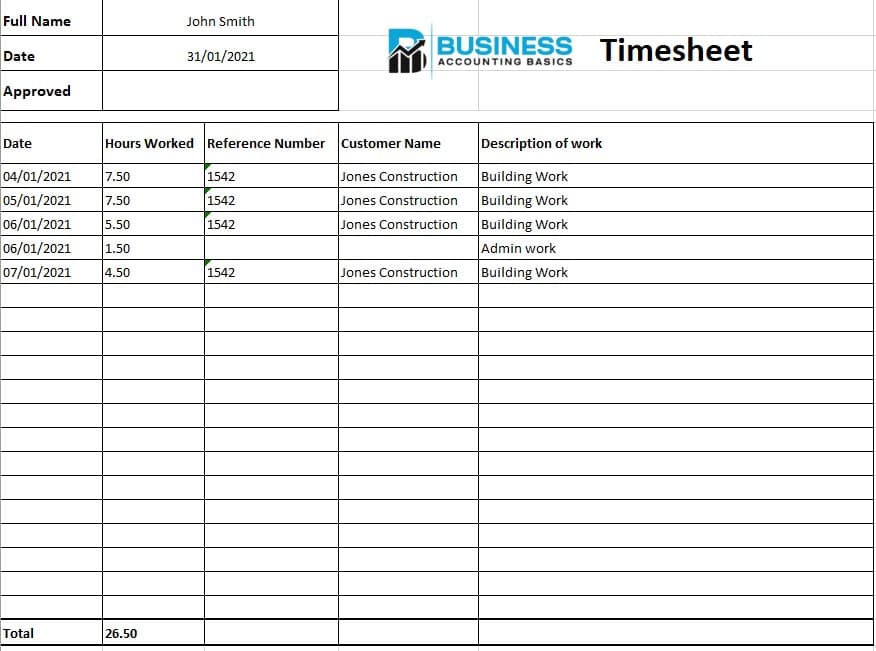

Our timesheet can assist with the process if you need to track employee or contractor hours.

Record the hours worked and customer details, including order references. This will make it easier to calculate the amount to invoice clients.

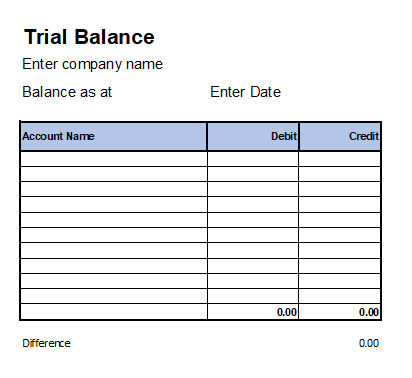

A trial balance is a valuable tool for checking the balances of all the accounts on the general ledger.

Our Excel bookkeeping template will assist with the process, along with a guide on completing a trial balance.

If you are using Excel Bookkeeping templates and require an alternative to Microsoft Office, we recommend Apache Open Office. It is free to download and use, and most features are similar to Microsoft’s. Another option is to use Google Sheets.

If you want to create your own Excel bookkeeping spreadsheets, take a look at our basic Excel formulas. There are also many tutorials available online and on YouTube.

Free Excel bookkeeping templates are great for starting small businesses on their basic bookkeeping journey.

We offer a wide range of accounting templates for basic bookkeeping and support if required. Excel spreadsheets are a great way to start recording your business bookkeeping. Our top bookkeeping spreadsheet in the UK is the cash book, with over 18,000 downloads.

Once your business grows, it is worth looking into alternative options for bookkeeping software offering a double entry bookkeeping system.

If you are unsure of bookkeeping tasks, we suggest hiring a bookkeeper or accountant. They have experience setting up a bookkeeping system and can advise on tax.

Angela Boxwell, MAAT, brings over 30 years of experience in accounting and finance. As the founder of Business Accounting Basics, she offers a wealth of free advice and practical tips to small business owners and entrepreneurs dealing with business finance complexities.

Angela has used and tested various accounting software packages; she is Xero-certified and a QuickBooks ProAdvisor. Experienced in using Excel spreadsheets for her bookkeeping needs and created a collection of user-friendly templates designed specifically for small businesses.